Setting aside arguments regarding the minimum required level of the Chinese reserves, the China's capital outflow is no longer just a woe but a phenomenon. The Chinese reserves had decreased by 483bn last year from its peak, and it is still declining this year as the January reserves were recorded at 3231bn(-99bn MoM).

Objectively, it seems too early to expect the Chinese reserves will completely run out in the near future. However, considering a connection between a capital flow and a house price, the accelerated capital outflows in China may cause its housing market bubble to crash.

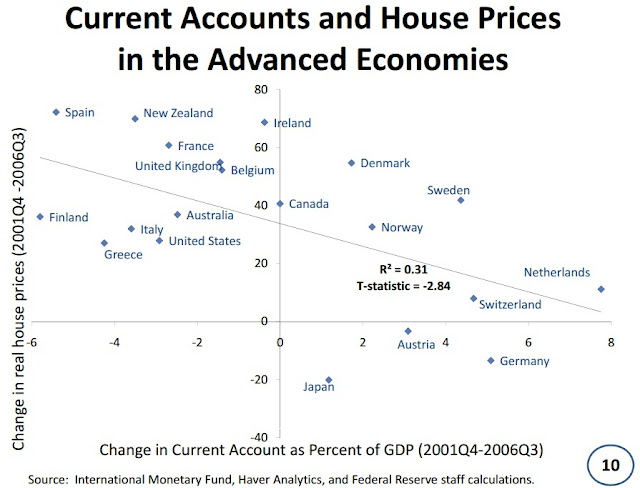

Ben Bernanke, a former Fed's president, is probably the most famous economist who have pointed out that capital flows can help to explain asset price fluctuation. On 3 Jan 2010, at the Annual Meeting of the American Economic Association, he illustrated the relationship between capital flows and house prices on the last page of his presentation.

If we agree with this concept known as a part of 'savings glut', the Chinese housing market is likely to be vulnerable to capital outflows because it has experienced a large capital inflow since 2008. A chart below shows the historical trends of capital flows and house prices in China.

(source : bloomberg)

Not surprisingly, the increase of the Chinese FX reserves was mostly driven by Fed's QE, and it was also correlated with the house prices fluctuation. However, there were some divergences between capital flows and house prices in 2011 and 2015 due to the PBOC's policy rate change. In the beginning of 2011, regardless of capital inflows caused by QE2, Chinese house price was stable since the PBOC raised its lending rates continuously. By contrast, the Chinese housing market was supported by PBOC's rate cut last year, even though there was a large capital outflow during the same period.

So, what the PBOC has to do is quite clear. It needs to cut its policy rates more not only for supporting economic recession but also for preventing balance sheet recession. If it doesn't, given the current situation that capital outflows has been accelerated, the Chinese housing market is highly likely to collapse in the near future, consequently.

댓글 없음:

댓글 쓰기